When faced with criticism, one of the most common responses from fans of Bitcoin is that its detractors just “don’t understand”. But this is a puzzling stance for them to take, because Bitcoin really isn’t that hard to make sense of.

Simply put, it’s a digital token that grants access to digital transactions. Those transactions are permanently recorded on a public ledger that’s designed to be incredibly hard to hack or falsify. This was true when Bitcoin was much smaller in scale, and it only becomes harder to hack as more people use it. No one person owns or hosts this online public ledger, so it should never disappear as long as people keep on using Bitcoin.

To be fair to Bitcoin lovers, this means that one of the common critiques of cryptocurrency also rings hollow: Some critics have argued that Bitcoin can’t ever replace other currencies, or replace hard assets like gold and silver, because it’s just too hard for the average person to wrap his or her head around. But it’s not.

The real reason that Bitcoin cannot and never will be “digital gold”—as its proponents now suggest we see it—is also pretty easy to understand, once you think it through. But in order to grasp it, we have to take a serious look at why Bitcoin is worth anything to begin with, and why gold (or any other good or currency for that matter) is worth anything at all.

Scarcity Alone Isn’t Enough to Create Value

Advocates of Bitcoin will be quick to remind you that there is a quantity cap baked into this market-leading cryptocurrency. No more than 21 million units will ever be “mined”. This scarcity, they believe, is a key source of its value.

But this is simply wrong. Contrary to popular misconception, scarcity alone cannot give any good its value. Scarcity only has the potential to set a floor for the price of a good.

People who misunderstand this also misunderstand why the more conventional “safety” assets, gold and silver, are worth anything to begin with. Despite the popular misconception, gold and silver are not worth something simply because they are rare. Instead, they are valuable because they are extremely useful to human beings.

A common critique of precious metals as a store of value is to simply snort that “you can’t eat gold”. Well, duh. You also can’t smoke a banana, you can’t fill your gas tank with concrete, and you can’t stuff your wallet full of thinly-cut slices of ham and expect that to work out well for you.

Much like bananas are not for smoking and concrete is not for fueling cars, gold and silver are not for eating. (That this has to be explained seems a little silly, but it comes up amazingly often!)

So what are they for?

Well, silver is for making iPhones and computers and solar panels and pretty, hypoallergenic jewelry and antimicrobial medical devices. Gold is for all those kinds of things, plus aerospace heat shielding and energy efficient windows and so on.

And, not at all unimportantly, yes: They’re shiny, and giving gifts of gold or silver, particularly to members of the opposite sex, has tended to help increase one’s chances of reproductive success throughout the millennia. (Go figure, but that seems to be fairly important to human beings, what with our being a biologically-reproducing species and all.)

The scarcity of gold and silver is simply not what gives them their bid. They have value because they are “goods” in and of themselves. They have value because they are valuable to humans.

Scarcity merely helps establish a floor for the bid. That’s why silver is used often for making antimicrobial medical devices, but not so often for making antimicrobial cutlery anymore, even though it makes for damn good silverware with built-in antiseptic properties. It’s also why gold is often used for making visors for astronauts or rings for new brides, but is not so often used for plating toilets, even though it can plate toilets just fine.

Scarcity only means that gold and silver tend to get purchased for their highest and best possible uses, while substitutes are used for their lowest-value applications instead. But their maximum price does not come from the scarcity. It comes from the fact that they are useful. (And yes, in addition to all the industrial uses, making pretty jewelry is considered very useful by humans. Otherwise, you figure people wouldn’t make it.)

Think of it this way: Mercury is about equally as rare as silver, and yet is costs a mere fraction of a fraction of what silver does. Why? Because while silver might save your life, mercury can literally kill you.

Clearly, scarcity alone is not enough to make mercury as valuable as silver. Usefulness is what makes silver orders of magnitude more expensive than mercury—even though their rarity is roughly the same.

It’s easy to forget, but this idea was essentially the basis for the plot of the classic Bond movie Goldfinger. In it, the villain plans to make all the gold in Fort Knox radioactive, thereby removing it from the useful gold supply and driving up the value of his own, less Chernobyl-y gold holdings.

While this may be a silly and far-fetched plot device, it is basically correct on an economic level: If gold had all the same properties, but would give you radiation poisoning or a bad case of dysentery just from handling it, then its price would start to fast approach $0, “scarcity” be damned.

The same basic idea holds true for Bitcoin.

So What Gives Bitcoin its Value?

In this way, Bitcoin is the same as gold and silver and anything else. It has a value because it has a use.

So, what is Bitcoin ultimately used for? It is used for one thing: It allows access to secure, public ledger transactions. That’s it. That’s all it does. That’s where it gets its underlying value from. It is a medium for exchange.

Is that useful? Yes! When people go on and on about how “blockchain is the future”, they’re right. It is the future. It’s a fantastic technological development. And it’s here to stay.

But guess what? The internet is here to stay too. That doesn’t mean that owning a piece of Friendster or Myspace or AOL or Prodigy or Pets.com will be a great long-term store of value for you.

Similarly, corn and wheat, as far as I can tell, are here to stay. But that doesn’t mean it’s wise to store all your purchasing power in corn or wheat futures for the long term. They’re just too easy to replicate when the price goes up.

Unfortunately for Bitcoin holders, the same is true for creating access to secure public ledger transactions: It is ultimately a commodity that is fairly cheaply and easily reproduced.

Those that argue that its not exactly “cheap and easy” to start up a secure public ledger need to reevaluate their sense of scale when it comes to commodities that are used all around the world. In a manner of speaking, it’s also not exactly “cheap and easy” to start a wheat farm or a lead mine either. But its easy and cheap enough that the commodity price is necessarily very low on a per-unit basis.

No Competitive Advantage = No Price Advantage

Lovers of Bitcoin correctly argue that yes, you can create a new cryptocurrency out of thin air at any time… but it won’t be Bitcoin!

Who cares? Bitcoin’s value isn’t that it’s Bitcoin. It’s that it can provide secure, decentralized, semi-anonymous public ledger transactions. That is literally all that it does.

Similarly, if you create your own cola brand, “it won’t be Coca-Cola”. But that doesn’t mean that Coca-Cola can ever go to $100,000 for a can of soda. Coca Cola costs pretty much whatever other colas cost, plus some small premium for brand recognition.

Being the undisputed market leader gives Coca-Cola a smidge of pricing power, yes. But it does not give it infinite pricing power. The same is true of Bitcoin.

To maintain its market-leader status, Bitcoin needs to do exactly what Coca-Cola does: Provide a useful product at a competitive price, perhaps with some small premium over major competitors due to name recognition.

But Coca-Cola has one thing going for it that Bitcoin doesn’t: It actually benefits from economies of scale. As their production and distribution networks have scaled up, Coke and its drinkers have actually benefited from reduced costs and increased efficiency and the like. It has become more efficient. Unfortunately, the opposite is happening with Bitcoin.

The Bitcoin Price is Going Up While its Underlying Value is Going Down

The big problem for holders of Bitcoin is that the larger Bitcoin gets, the slower and more expensive it gets. That’s not exactly ideal for a medium of exchange that’s supposed to take over the world some day.

As Bitcoin gets larger, it also becomes increasingly susceptible to government bans, regulations, and tracking. After all, it is literally a central database of all transactions ever made, permanently linked to your wallet address. But let’s put all that aside for the moment in order to give the pro-Bitcoin argument a leg up.

Long story short is that Bitcoin’s primary value comes from the fact that it can be used as a medium of exchange. Unfortunately, the more people who adopt it, the worse it becomes as a medium of exchange. This has been playing out to a point now where Bitcoin is slower and more expensive than the legacy big-banking payment system it set out to replace!

Think on the absurdity of that: Bitcoin is already becoming slower and pricier than the very system it was supposed to replace by being a cheaper, faster and more anonymous alternative. And it hasn’t even reached anything near its proposed scale yet.

Bitcoin proponents now say “Oh, well don’t worry, it won’t be a medium of exchange now. It will be a store of value instead! Like digital goooollllllld!”

But wait, if its sole value comes from its being a medium of exchange, and it’s not valued for being a medium of exchange, then how can it maintain its value?

Well, it can’t. Obviously.

Bitcoinbugs will argue “scarcity!” But as discussed earlier, that would be a lot like saying “I have a gold necklace here that will give you radiation poisoning if you touch it. How much do you bid?”

I bid zero. Thankyouverymuch. Scarcity alone simply cannot give a commodity its value.

Bitcoin is a Digital “Tower of Babel”

The smartest Bitcoin proponents are already starting to realize this. There’s now a large movement of them who are already ditching Bitcoin for a spinoff called “Bitcoin Cash” because it’s faster and cheaper than the original Bitcoin. They even want to to be considered the “real” Bitcoin.

Bitcoin Cash has an advantage over other “alt coins” because it already comes with a built-in user base. It was “forked off” from the original Bitcoin, meaning that anyone who owned Bitcoin this summer when the fork occurred automatically owns and equal amount of Bitcoin Cash. So they don’t even have to try to get new users to adopt it. The main existing audience for cryptocurrenices already owns it.

These rogue crypto-advocates are right to recognize that the real value of Bitcoin is in providing secure public ledger transactions, and they realize that to be good at doing this, it needs to be cost-effective and fast as well as secure. Otherwise, it’s just not very useful, which means it’s not very valuable.

Their only mistake is in not taking this logic further: If Bitcoin Cash can replace the original Bitcoin, then why can’t yet another spinoff replace Bitcoin Cash?

Just as some people still prefer the original Bitcoin to Bitcoin Cash, some would likely prefer the original Bitcoin Cash to the new, arguably superior Bitcoin Cash 2.0.

What, after all, is the “best” way to run a blockchain? Big block size or small block size? High unit price or low unit price? 21 million coins or 2.1 million or 2.1 billion? Is a 1 day transaction fast enough? How about 1 minute? 1 second? What would you be willing to pay for a 1 second transaction instead of two?

I don’t know. What’s the “best” way to make a car?

There is no single “right” answer to this question, just as there is no “right” answer to whether “agua” or “water” is a better word for H20.

The Bitcoin Price is Doomed. Long Live Blockchain.

These are the reasons that Bitcoin’s quantity cap is ultimately meaningless.

First, scarcity alone can’t give a commodity or currency its value. Otherwise, mercury would be as expensive as silver, and my paintings would be as valuable as Van Gogh’s. (I’ve barely ever painted in my life, so mine are even scarcer! ka-ching.)

Second, the underlying commodity at play—access to public ledger transactions—isn’t that scarce to begin with. It is easily replicated by other providers, so the price floor due to unit scarcity isn’t even really there.

Ironically, Bitcoin’s main value proposition is likely to be its greatest downfall: Decentralization really does work. and they may actually benefit from smaller size.

Bitcoin itself was far more efficient, fast and inexpensive when it was much smaller. Economies of scale seem to be hurting Bitcoin much more than helping it. And it puts a huge target on its back, both for bans and regulations, and the tracking of transactions by governments and malicious private actors alike.

Decentralization Works

Now, Bitcoin fans will correctly argue that you can’t just create a crypto currency willy nilly and expect it to work. It has to have enough users to be secure!

Yes, this is true. But Bitcoin itself is evidence that a crypto-currency doesn’t need to reach anything like world-dominating scale to be secure.

In the grand scheme of things, Bitcoin operates at a very, very small scale, compared to the rest of the financial system, and yet it is insanely secure.

And guess what? It was also insanely secure last year, when it was dramatically smaller. And it was insanely secure the year before that when it was smaller still! …And, the year before that too, when it was even tinier.

While it’s true that a public blockchain needs sufficient size to be secure, it does not need huge size to be secure.

In addition, a blockchain doesn’t even need to be public to work well. Blockchains can potentially be even smaller and just as secure if they are privately owned.

Sure, this would require adding some small and reasonable level counterparty risk. But this is what the vast majority of Bitcoin holders already do. They hold through services like Coinbase, that aren’t even as secure as a private blockchain would likely be.

In any fantasy land scenario in which Bitcoin took over the world currency system, these kinds of services would be how the vast majority of users would hold it anyway. And they are probably riskier than a well-designed private blockchain would likely be.

(Also, Bitcoin itself has counterparty risk if you really think about it, but that’s a story for another day…)

Digital Commodity, Yes. Digital Gold, No.

Ultimately, crypto-tokens, including those made by Bitcoin, are a lot more like digital corn than digital gold. Or more accurately yet, they’re like digital checkbooks.

Do checkbooks have value? Yes, absolutely. But I wouldn’t recommend stacking pallets of them in your basement.

Blockchain is here to stay, yes. Blockchain is the future, sure, you’ve got it. But the future of blockchain is in providing a large quantity of low-margin transactions. That is the underlying economic reality.

In the meantime, I’ll continue selling the Bitcoin I own as the price continues to go up. I’m already up tens of thousands of percent. Sure, just because it’s a bubble doesn’t mean it can’t go higher. I fully expect it to hit at least $10,000. Maybe $25,000 or $40,000. Who knows? Hopefully I’m smart enough to be out before it hits a final top, and smart enough to not sell it all too soon.

I just hope, for your sake, that you’re not one of the people I’m selling to. While there’s a fairly good chance that Bitcoin will exist 10 years from now (and it could be a store of value from some dramatically lower price level) it will not be and cannot be a store of value from this price level. Not in real terms, anyway.

________________________________________________

As always, make sure you to hear many voices and come to your own conclusions. Think it through. Get the best arguments from all sides. I can’t tell you what to do, but I can tell you what I am doing. I bought Bitcoin because I was fairly convinced it would go up, and am slowly selling it because I am largely convinced that it must eventually go down.

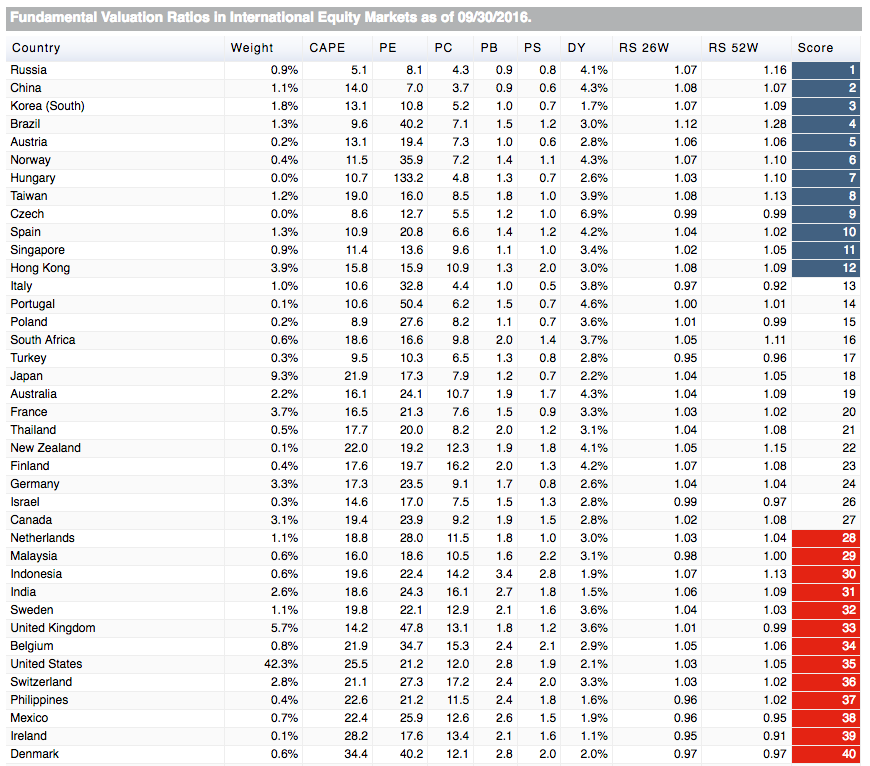

What am I buying now? The same things that have been on sale and that I’ve been buying for years now: International stocks where they are selling at reasonable valuations, undervalued hard commodities like platinum, oil, gold and silver, and investments in my own business. It is a strategy that has been beating the pants off of investing in the S&P 500 at its current, radically bubblicious valuation level.

Would I have done better by putting all of my money in Bitcoin? Yes, absolutely. For a while anyway. But nothing that can’t last forever, does. And, if I had, then I’d have to feel even guiltier about the huge number of greater fools whose cash I was taking at these crazy and unsustainable prices.

Consider this post my penance for that. I tried to warn you. So my conscience is now clear. Good luck, whatever you decide! Just remember that bubbles go up. Until they don’t.