I get some great emails about the investing strategies I’ve talked about on this blog. Here’s one that came in just this morning.

Hi Justin,

I enjoy reading your blog and feel like you offer wonderful insights in posts like “The Independent Musician’s Guide to Not Going Broke” from 2013, and “How to Tell When Stocks Are Overpriced” from earlier this year.

But it seems like your views have changed over the years from the first post to the more recent ones.

Is the “set-it-and-forget-it” type investing not the thing to do in this day and age?

I’m a newbie investor and the thought of spending my own time and doing my own research and investing in commodities or international funds puts me off.

I don’t know enough about investing, so for the average Joe like me, what would you say is the best course of action? Is continuing to regularly contribute to my 401k & Roth IRA in index funds without thinking the wrong way to go about securing my retirement?

Thank you for your help!

I love this question.

First of all, remember that you’re talking to a music geek and a part-time econ nerd, not a professional financial advisor. So I always recommend getting a second opinion before changing your investing strategy too significantly.

But with that said, sure, I get it! You are talking to someone who thinks about this stuff more that he probably should, and who has been studying markets in detail for many years as something of a weird, but very gratifying—and reasonably lucrative–hobby.

I get that not everyone wants to spend that kind of time thinking about these things. Fortunately, the more I study investing, the more that I realize that the key takeaways are very, very simple indeed, and require almost no time at all to implement. Here’s the basic idea:

YES. IRAs and 401ks are a great vehicle for long-term investing, and it’s wise to contribute money that you don’t plan on touching for 10-30 years into one of these for all the tax advantages that they offer.

YES. Index investing and the buy-and-hold approach are great ways to get great returns over the long haul.

YES. You don’t have to think about investing all the time to get great returns, and adopting a strategy to “set it and forget it” for long periods is very smart move indeed.

BUT: Buying US stocks is not the only set-and-forget strategy you can take. And, when US stocks are overpriced there may be other, wiser, safer and more lucrative “set-it-and-forget-it” strategies to adopt instead.

Fortunately, these other strategies are just as simple and easy to undertake. If you want to invest as little as a handful of hours once every few months into researching even better deals for your current and future income, then you could have even better returns.

Of course, as a non-professional investor, the idea isn’t to follow every little market squiggle and research every single company in depth. The idea is not to make this into your “side hustle”.

The idea is still to develop a sensible, “set-it-and-forget-it” approach—but to adapt that approach once in a while as the world changes, and as some assets start to become overpriced, while others start to become underpriced.

What I’m Doing

I still stand by the long-proven investment strategies in “The Independent Musician’s Guide to Not Going Broke“, but with one important exception:

As great of an idea as it is to buy and hold stock indexes for the long-term, I do not recommend exclusively buying U.S. stocks when they are overpriced.

I mentioned this key idea in passing in that original article. But more recently, as U.S. stocks continue to become overpriced, I’ve felt it’s appropriate to get a bit more specific about exactly what I mean by that idea—and about how you can easily figure out what kinds of investments you might buy instead.

None of this, however, is not to say that you should necessarily sell the old U.S. stocks you bought—especially if you got them at a fair or low price to begin with!

If your time horizon for holding is “forever”, then continuing to hold stocks when they are expensive can certainly be justified.

(Just don’t freak out when their value drops in the short term if your time horizon for investing is not short term.)

But as far as buying new stocks and investments? That’s a different story.

When US stocks are overvalued, it just doesn’t make sense to me to buy more—so I buy other things instead. I simply have not seen any evidence to suggest that the mere passage of time can turn a bad deal into a good one.

Fortunately, finding better deals isn’t hard!

Finding “The Best Deal” may be difficult, but finding “Better Deals” is easy.

Fortunately, you don’t have to be some stock market obsessive to find better deals than the currently overpriced U.S. stock indexes.

As I write this, the “CAPE” or “Shiller PE” ratio for U.S. stocks. is around 26. (This is basically a long-term average of how many dollars you have to pay to get a share of $1 of earnings per year.)

As you can see for yourself, the CAPE ratio has never been this high except for the times shortly before the great stock market bubbles burts of 1929, 1999 and 2008.

The “CAPE” or “Shiller PE” ratio of the U.S. stock market. This is a 10-year average of price-to-earnings ratio for the entire S&P 500 index.

Pretty chilling stuff, right? Holding your old U.S. stock indexes may make plenty of sense. But buying new ones? I’m skeptical, to say the least.

(Of course, I’m also skeptical that holding too many dollars is a good idea over the long term, for reasons that should be obvious to any investor.)

But my solution for this is simple:

When U.S. stock indexes are overpriced by the CAPE ratio, I simply look at the CAPE ratio of stock indexes in other countries that have decent prospects for the future, and see if they are in better shape.

Once I’ve identified which trustworthy countries seem reasonably or cheaply priced, I simply buy a diversified baskets of those markets. Done!

It’s actually pretty easy to quickly check the CAPE ratio of different foreign markets. I often go to Star Capital’s website, which has a handy, easily-sortable chart of P/E ratios, CAPE ratios and dividend yields by nation, updated quarterly.

In the U.S., I feel like any CAPE ratio under 15 is probably a fairly good deal, anything under 10 is a steal. Anything over 15 is higher than average, and anything over 20 is way to high for me to buy based on historical norms.

Since I think there is potentially a bit more risk in any individual smaller or emerging country, I might prefer to see those respective numbers a little bit lower than I would for the U.S. And, I prefer to buy diversified bundles of several countries at once.

So, I’m basically doing the traditional, buy-and-hold passive index investing approach, but taking a very small amount of time to look for good value within that strategy.

The Tools I Use

I also like to use Motif Investing to create my own custom, diversified baskets of indexes and buy them all in one go. I can buy a whole bundle of up to 30 stocks or ETFs this way for $9.99, so it’s a lot cheaper for this kind of thing than conventional brokers.

I can also check PE ratios and dividends yields there. And as mentioned, tools like Star Capital’s international ETF screener can give me quick insights into current CAPE ratios and other stats I can’t find on Motif.

(Disclaimer: I have no affiliation with Motif, other than just being a user, but it really has been a great tool for me. This is a referral link, so in case you like they idea, this will give you a free $100 to get started. If you fund an account with just $1,000, that’s like a guaranteed 10% return—even if you just buy a Motif consisting only of U.S. dollars or U.S. stocks! Most investors never consistently get a a return as high as 10%, so that’s pretty hard to pass up.)

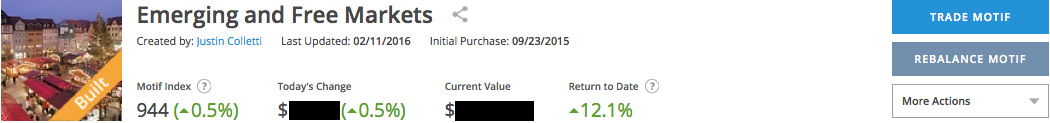

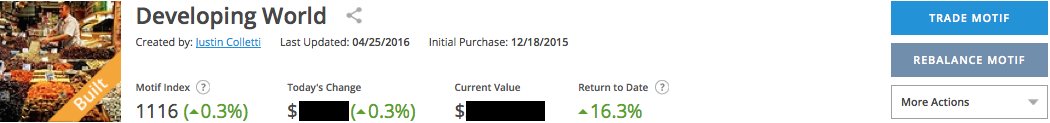

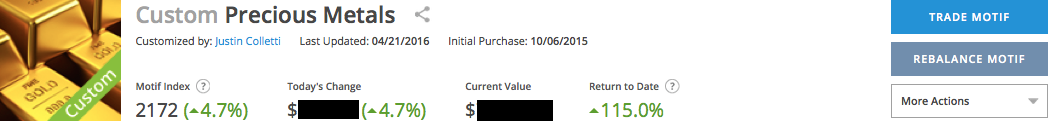

Below are some of my results using this strategy on Motif’s platform.

Dollar values below are obscured for privacy, but you can easily see just how well these simple investments have done compared to the S&P 500. For a variety of reasons, I believe that these investments are safer than investing in U.S. stocks at the current time, as well.

My Results With Value-Based Index Investing

Above is my “Emerging and Free Markets” Motif, which returned 12.1% since late September, compared to 8.25% for the S&P 500. That’s an out-performance of almost 50% in less than a year.

On top of this, the dividend returns are more than double that of the S&P. And, since these stocks are at lower valuations already, they are likely to drop by less in the event of a market downturn. These are all benefits of “buying low”.

This was one of my first ever baskets using Motif, and the first one using this strategy. It was also an extremely lazy investment.

All I did was buy indexes from countries that had low CAPE ratios and had dropped in price in recent months or weeks. All of this was easy to check between a chart of international CAPE ratios and Motif’s built-in tools.

This took very little homework. Only about a half hour, plus a very good framework for understanding what investing is really about.

My “Developing World” Motif is an even more aggressive version of this strategy. It has returned 16.3% in the past 6 months alone, compared to 2.1% for the S&P 500.

It focuses a little less on already-developed markets, and a bit more on great deals among the fastest growing nations with the best long-term prospects for growth.

Instead of taking just under a half hour, it took just over a half hour, and a bit more guts. But I still consider it a far more conservative and less-risky investment than buying U.S. stocks at their current valuations.

Again, the dividend payouts are more than double that of the S&P 500 and the future prospects from this level are brighter.

Again, these stocks were bought when they were already hammered down to a very low level, so there is far less downside risk than with US stock indexes at their current price levels.

Above is the real stunner of the batch. Check out that “return to date”.

I created my own customized version of Motif’s basic “Precious Metals” basket in October when the gold price was headed near a bottom. I really started piling into it in December when the gold price hit as low as $1050. This turned out to be its 52-week low.

This Motif is up 115% in about 8 months compared to 5.83% for the S&P 500.

That’s about 20X out-performance on what clearly seemed to be a very low-downside risk compared to the S&P 500 at its current price.

Some people would think that this kind of thing is a more reckless investment than buying the S&P 500. I disagree.

I say it’s far lower risk from a long-term perspective than owning the S&P 500 because the gold price and gold stocks were dramatically lower than they likely should have been, while the S&P 500 is dramatically higher than its norms.

Buying things that are more expensive than they ought to be is reckless investing. Buying things that are undervalued and holding them til they’re not—while collecting good dividends along the way is bother smarter and safer investing.

How To Do It

I can’t promise you will have results that are as good these if you want to try making your own Motifs, but I am not exaggerating on how little time I actually spent putting them together.

I probably spent around 30 minutes on each, and most of that was just hemming and hawing over what is probably inconsequential minutia.

To inform these choices, I just used the very simple strategy and tools outlined above, and kept some mental notes about different countries I’d hear about in the news. Which ones are continuing to do better? Which ones have been starting to do worse?

I have to add that I do read books and get excited about watching videos from my favorite economists and market commentators whenever they come out, but I really can distill all I’ve learned, and this whole strategy down to a few very basic ideas:

- Buy things that are undervalued and avoid buying things that are overvalued.

- Seek to get paid for owning, rather than selling, your investments.

- Once you’ve identified what the better and worse deals are, “set it and forget it”. Largely ignore the day-to-day squiggles of the market.

- Revisit your strategy once every season to see if it’s the best place to keep on putting your money. If not, put your new money toward new things.

- If any of your investments get really overvalued, consider selling them and buying undervalued assets. This step is not necessary if you have a long-term time horizon, good dividend payouts, and prefer a strict buy-and-hold approach.

That’s it.

Because I follow this approach, I was smart enough to buy into indexes of countries like Singapore, Hong Kong, Australia, Norway and several others after their value had gotten hammered into the ground by questionable expectations of Federal Reserve rate hikes in the future.

Later, I started seeing potentially great value in parts of Eastern Europe and the EU such as Poland, Hungary, Turkey, Spain, Norway and Austria, as well as developing markets Brazil, Chile, Vietnam and Singapore. Again, I didn’t have to do much. I just looked at international CAPE ratios, filtered out seemingly great deals in any countries that made me nervous, and made myself some Motifs.

This turned out to be a good idea in both cases, as the value of these markets have gone up significantly since their lows. But even more importantly, they paid a dividend much higher than US stocks in the meantime, and would have been a good deal even if their price dropped further.

In the first case, I got a 12% return, meaning I did 50% better than the S&P’s 8% return in the same time period and collected more than twice the dividends while I was waiting, all in about 8 months. In the second case, I got a 16% return compared to the S&P’s 2% return I got about 600% better performance than the S&P, all within about 6 months—While collecting more than double the dividend payout.

When you put some money into a basked of international indexes, will all of them pan out to be great deals? Well, the point of diversification is that they don’t all have to be. But overall, I trust the long-term prospects of buying underpriced indexes more than the prospects of overpriced ones.

Commodities, Precious Metals and Better Banks

Yes, I have also been diversifying a bit into undervalued commodities like silver and oil among others.

This has been a good strategy, as I started buying into silver around $14, oil around $29 and gold around $1050 very recently, and they are all up pretty considerably since then. Last I checked they were around $19, $49 and $1330, and I’d expect them to go significantly higher over the next few years, rather than lower.

Though I own some of these in the form of ETFs, commodity indexes and related stocks, I also have taken to holding a bit of gold in what is essentially a gold-backed savings account from BitGold. I can even spend this gold anytime I like, using a pre-paid MasterCard. It’s certainly cheaper than buying gold ETFs or physical bullion in small quantities, and arguably, safer than either as well.

I also believe it’s a better alternative to contemporary banking accounts, which give you a rate of interest that is, in many or most cases, lower than the rate of inflation. Then, they take anywhere from 80% to practically 98% of your deposited money and lend it out, often in bad investments.

Even if the major banks do stay solvent through another financial crisis (which seems unlikely) you’re still guaranteed to lose money with them, right now. That’s just what happens when the interest rate you are getting is effectively negative after you account for inflation.

I still think that the idea of buying a holding stock indexes for the long term is a very good idea. I just think that buying things that are on sale is a better deal thank unthinkingly buying anything, no matter how expensive it may get.

Again, I can’t tell you what to do, and I wouldn’t recommend taking this as investment advice, just as one man’s example. But I hope it helps to detail my own strategy and reasoning a bit better.

Disclaimer: This is one man’s opinion and research, and should not be construed as investment advice. As always, be sure to seek other voices, do your own research, and seek out trusted professionals if desired.