There are a lot of people who work in financial fields who have a hobby in music. It may be somewhat more rare to find the opposite: People who work in music who have a (reasonably lucrative) hobby in finance, but hey, I’m weird like that.

Lately, I’ve been finding more and more crossover in interest between the two, and each time there’s some tension in the US stock market, I see my inbox fill up with questions related to some of my recent posts—both from inside the music community and out. Here’s one from just this morning that I liked a lot:

Hi Justin,

I was reading some fairly recent posts of yours…and I have to echo your thoughts on stocks being overvalued. I was wondering if you had ideas for more fairly priced assets in this market.

I’m still indexing with Vanguard but for bond holdings [and] I’m tilting to short term [bonds] to protect against rate increases. Also diversifying with P2P lending.

Any other ideas?

YES. As good fortune would have it, I’ve found that there are many nations where the “CAPE ratio“—probably the most reliable metric for estimating long-term stock returns—suggests that their stock indexes are still fairly or even cheaply priced.

Last I checked, you could easily find cheaply or fairly priced stock indexes to buy in strong, respectable nations including Singapore, Hong Kong, Taiwan, South Korea, Austria, Spain, Portugal, Poland and several others.

With CAPE ratios in the neighborhood of 8-15, stock indexes in nations like these should be expected to return something like 7%-12% per year over a 10-year period, with less than average downside risk for stocks.

Compare this to US stocks, which would historically be expected to return something like 2%-4% over a 10-year period from at the current price level—with pretty significant downside risk in the near term.

With a big position in US stocks, you’d be likely to see near-term drops of 40% or more just to get back to “fair” valuation territory. And as we know, markets tend not to just “correct”, but to overcorrect, passing right through fair territory and into despondent undervaluation for reasonably long stretches of time.

(This would imply a drop in purchasing power of significantly more than 40% in the foreseeable future, and perhaps by as much as 50%-80%. While this may sound dramatic, it does happen repeatedly throughout history.)

Meanwhile, foreign stocks in nations such as Singapore, Hong Kong, Taiwan, South Korea, Austria, Spain, Portugal, Poland, Norway and others have already been beaten down to very attractive price levels for a variety of reasons. Therefore, it is easily plausible that they would drop by less than US stocks in a short-term deflationary market crash.

On the other side of the coin, since they have a lot farther up to go before reaching overvaluation. If we were to experience another leg of an inflationary asset price boom like in the 1970s or early 2000s, these same assets would likely go up much more than US stocks, as they have much more room to do so while still remaining a good deal.

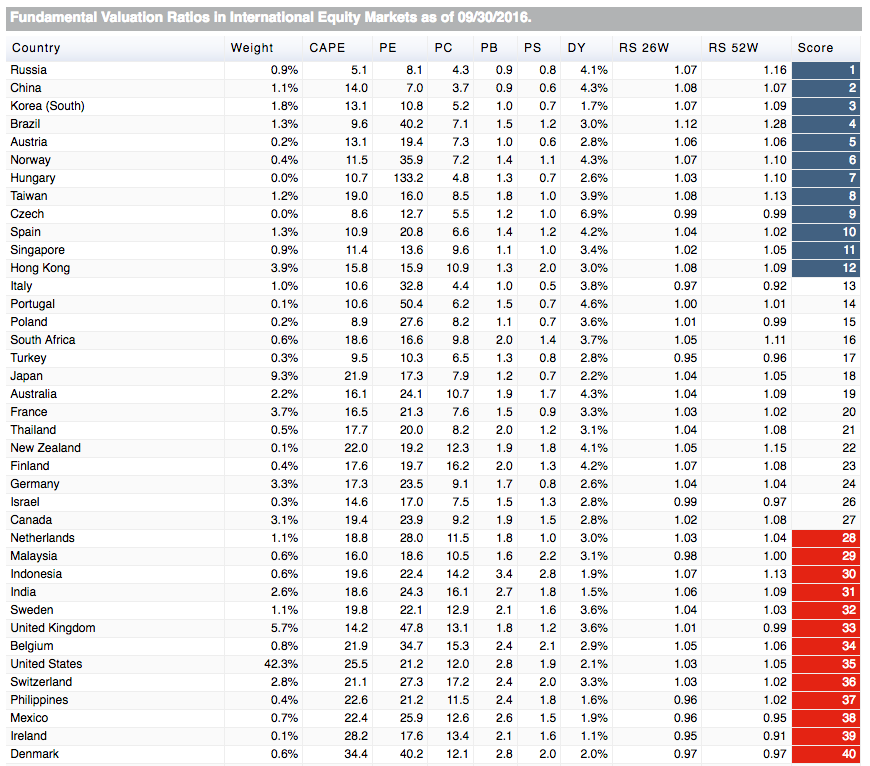

It’s easy to check the stock market valuations of a variety of different nations for yourself. Here’s a screencap from Star Capital’s database that lists CAPE ratios and dividend yields by nation. You can play around with this interactive chart for yourself and sort it by CAPE ratio or dividend yield if you like:

As you can see, if you’re really aggressively value-oriented, you might consider some degree of long-term investment in exceptionally inexpensive foreign markets like Russia or Turkey or Brazil, but that isn’t even necessary when good deals can still be found in so many nations with even better track records.

What About Bonds?

Bonds, particularly government bonds, are now clearly in a bubble.

In so many nations around the world, once you consider the effects of inflation, you’d effectively have to pay them money just for the privilege of loaning them your cash.

In what world does that make sense?

We are mortal, meaning having a dollar today is preferable to having a dollar tomorrow. That is the whole reason interest rates exist.

Yet, our current situation is one in which “negative real interest rates” have become the norm. The concept is easy to understand, but bewildering to contemplate:

If you own a bond that pays a 2% return and inflation is running at 3%, you are guaranteed to lose money for holding that bond.

Yet, there are enough people are lining to buy them? This is what a bubble looks like, by one definition of the word.

(Though to be fair in investors, many of the “people” buying these bonds are the very governments issuing them, which is fairly perverse when you really think it through.)

What Can You Do About It?

Often, when aggressive speculators see such an unsustainable bubble, they look for ways to “short” that investment.

Basically, this means that they borrow that overvalued asset, sell it on the marketplace, and hope to buy the asset back and return it once its price has crashed. You’ve probably heard about the strategy by now. There was even a big movie about it lately.

But there’s a big problem with shorting government bonds, because the question remains: What are you going to short them in? When a speculator sells a borrowed bond, they have to hold something.

For instance, if you were to short Japanese yen-denominated bonds by trading them in for dollars, sure, that could make sense. Provided that Japan continues to print new yen faster than the U.S. prints new dollars, the dollars you’re holding should become more valuable than the yen.

This plan, of course, is contingent on central banks doing what you hope they will do, which seems risky and speculative to me—and quite a bit farther away from the sound principles of value investing than I am comfortable straying.

Shorting US government bonds to hold dollars would strike me as even more foolhardy still, because if things go bad for the US government’s ability to pay back those bonds, they can and will just print more dollars, if history is any guide.

Rather than go shorting bonds in any sector, my preference is to hold some bond alternatives, including commodities that are likely undervalued or at least fairly-priced compared to their historical norms.

Currently, that’s most of them—though I am particularly attracted to silver, platinum, palladium and base metals, the price of which seems especially hammered down relative to all other assets.

While I don’t expect another huge bull run in commodities like we saw in the early 2000s, I’d wager that they’d have more upside than US stocks in a very inflationary scenario and would drop by less than US stocks in a deflationary crash scenario.

At the same time, it is reasonable to suggest that in aggregate, they would hold their current values fairly well in the somewhat less likely event everything’s totally fine in the financial sector and we just have some slow growth and low levels of inflation.

What about higher yielding “junk” bonds and P2P lending? I’d suggest that current debt levels are way to high to feel comfortable with these investments.

If interest rates rise further, a lot of loans will fail. On the other hand, if governments around the world go into yet another round of “QE” (aka “modern money”) you’ll get all the interest and principal you were promised. It just won’t keep pace with inflation in the long term.

History’s Alternative to Bonds

The most direct and obvious alternative to holding (or shorting) bonds is to simply hold some gold.

I know, I know. “Barbarous relic” and all that. A few years ago, I was skeptical too.

The anti-gold crowd are right to say that holding gold seems like a silly thing to do in times of positive real interest rates, when you can get a real return over inflation by simply holding “safe” cash and bonds.

But holding some gold starts to seem like a no-brainer in times of negative real interest rates, when the carrying cost of gold drops below the carrying cost of cash in the bank and in bonds, both of which are guaranteed to lose you money when real interest rates are negative.

Even more cheaply-priced than gold right now are gold mining stocks, which were hammered down to some pretty incredible lows after people mistakenly thought that the Fed would be able to “normalize” policy years ago.

If you divide the price of gold mining stocks by the price of gold, you’ll see that sector is at practically all time lows by that metric, which I think is a relevant and important one.

Unless you think man’s urge to dig useful things out of the ground is going away sometime soon, I’d suggest that all-time lows can only last so long. At some point, a commodity sector can stay in liquidation so long before prices start to rise, assuming humans still value that commodity.

In turn, my holdings of gold mining stocks shot up by more than 100% earlier this year and continue to be up significantly even after a short-term decrease a week ago.

A Buying Opportunity?

In case anyone is interested, I’d suggest that the recent price drop in gold by a bit less than 10% was caused by short speculators dumping tons of gold when the Chinese—today’s biggest buyers of gold—had closed their markets for their national holidays.

This was a truly brilliant move for any speculator who wanted to short gold for the near-term and take advantage of that anomaly, and in hindsight, I wish I had though of it myself! (Even if I’m too much of a risk-averse value-minded investor to have actually done it.)

To me, this surprise price dip of $100 represented a welcome buying opportunity, as I had been considering suspending my monthly allocation toward gold as the price continued to climb higher and higher. (I probably have enough already. I wouldn’t recommend that anyone hold a majority of their assets in any single class.)

If you’d like to take advantage of the recent price dip, this can be done by buying some coins or bars, holding an ETF (I prefer SGOL, CEF, GDX and SGDJ to the overleveraged GLD fund) or my favorite method, opening a gold-backed, credit-card accessible savings account with Goldmoney.

Goldmoney accounts are backed 1:1 by gold that you own directly in a vault and legally, cannot be sold out from under you, even in bankruptcy.

It’s cheaper (and I’d argue, probably safer) than holding gold in either an ETF or a physical form, can facilitate low- and no-cost payments to peers and other businesses, and can be spent directly via a gold-backed MasterCard.

It’s an idea that sounded kooky to me at first, but the more and more I turn it around in my brain, the more I can’t help but admit that it makes a lot of sense, particularity in a negative real interest rate environment.

The Short Version

So that’s it:

Compared to US stocks and bonds, there are at least a dozen nations that offer attractive valuations for buy-and-hold index investors.

Many commodities seem fairly priced or under-priced, and holding a little sliver of those may not be a bad idea. (They’re also one of the only asset classes that are negatively correlated with stocks, meaning they tend to do well when stocks do badly.)

Some cash or “cash equivalents” like T-bills are probably useful to have in case of a near-term deflationary crash. People are creatures of habit and will likely run to cash in that scenario.

After that, some holding of gold will probably be more useful to have than some cash, as today’s central banks appear at the ready to simply print more money in case of crisis.

Just to be safe, it may be a good idea to hold some right now instead of waiting for them to go on sale in a short-tern deflationary crash, in case we skip that deflationary crash and go straight into further inflation, much like in the 1970s. (I think this is more likely, but it’s anyone’s guess.)

At the very least, one would likely be wise to avoid holding too much of the most bubbly and overvauled assets around: US stocks and bonds at their current prices.

There is evidence to suggest that even if you don’t find the best deals, simply avoiding what you can clearly identify as being the worst deals is likely to set you apart from the average investor.

Disclosure: I am a professional writer, mastering engineer and businessperson. I am not a professional financial consultant, and none of this should be construed as investment advice. It is my opinion and reasoning and representative of how I am handling my own investments. As always you should do your own research and consult with any of your own trusted tax or financial advisors.